The Carrot Way

Carrot started its journey by tackling the motor insurance sector. The traditional insurance companies have not been transparent when pricing the covers. Fairness at the individual level has been largely ignored. We are challenging the industry by building a company that recognizes each individual is unique and puts customers in control, rewarding them for their actions.

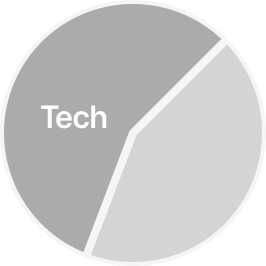

By leveraging technologies, such as AI, big data and IoT devices, we base rates primarily on how much people actually drive, as well as how safe their driving habits are. The result is a far more personal, fair and much simpler experience – thanks to it all being in an app. Registering almost 100k subscribers within the first year since launch of the product demonstrates that the society has long been waiting for such innovative approach. In addition, we have released other smart micro coverages that can be switched on/off as per customer’s need and lifestyle basis, namely travel, mobile phone protection, pet and p&c coverages. All of this reflect our customer-centric philosophy and commitment towards offering superior value and convenience to our customers.

The way we design and deliver insurance is not simple tweak to the traditional insurance model – we are fundamentally reinventing financial instruments through technology, data science and everything that we do stems from maniacal focus on customers. We believe that we represent future of Insurance and are here to make radical paradigm shift in the legacy industry. While our opportunity is expansive and our ambition is global, our purpose-driven journey has just taken off. We will be keep pushing it forward to seek new avenues to create aspiring products for our customers and the society that are financially sound and beneficial.